Full Report : The Next Battlefield After the Foundation Model War[January 2026]

If you've been watching the foundation model market, you've likely noticed something unusual. The market dynamics that used to play out over years are now happening in months. Models that seemed cutting-edge become obsolete overnight. Everyone's racing to build the same thing, and the gap between leaders is shrinking fast.

This isn't just competition—it's compression. And it's creating one of the clearest examples of a red ocean market I've seen in my career.

Foundation Models: Red Ocean

Red oceans represent existing markets where competition is fierce, companies fight over the same customers, Incremental improvement and differentiation. The foundation model market has all the hallmarks:

Market Dynamics Accelerating Beyond Recognition

In traditional software markets, competitive dynamics might shift over 12-18 months. Foundation models are different. What takes a year in normal markets takes months here. A model that dominates in January can be leapfrogged by March. The cycle time between major capability improvements has compressed from years to quarters to months.

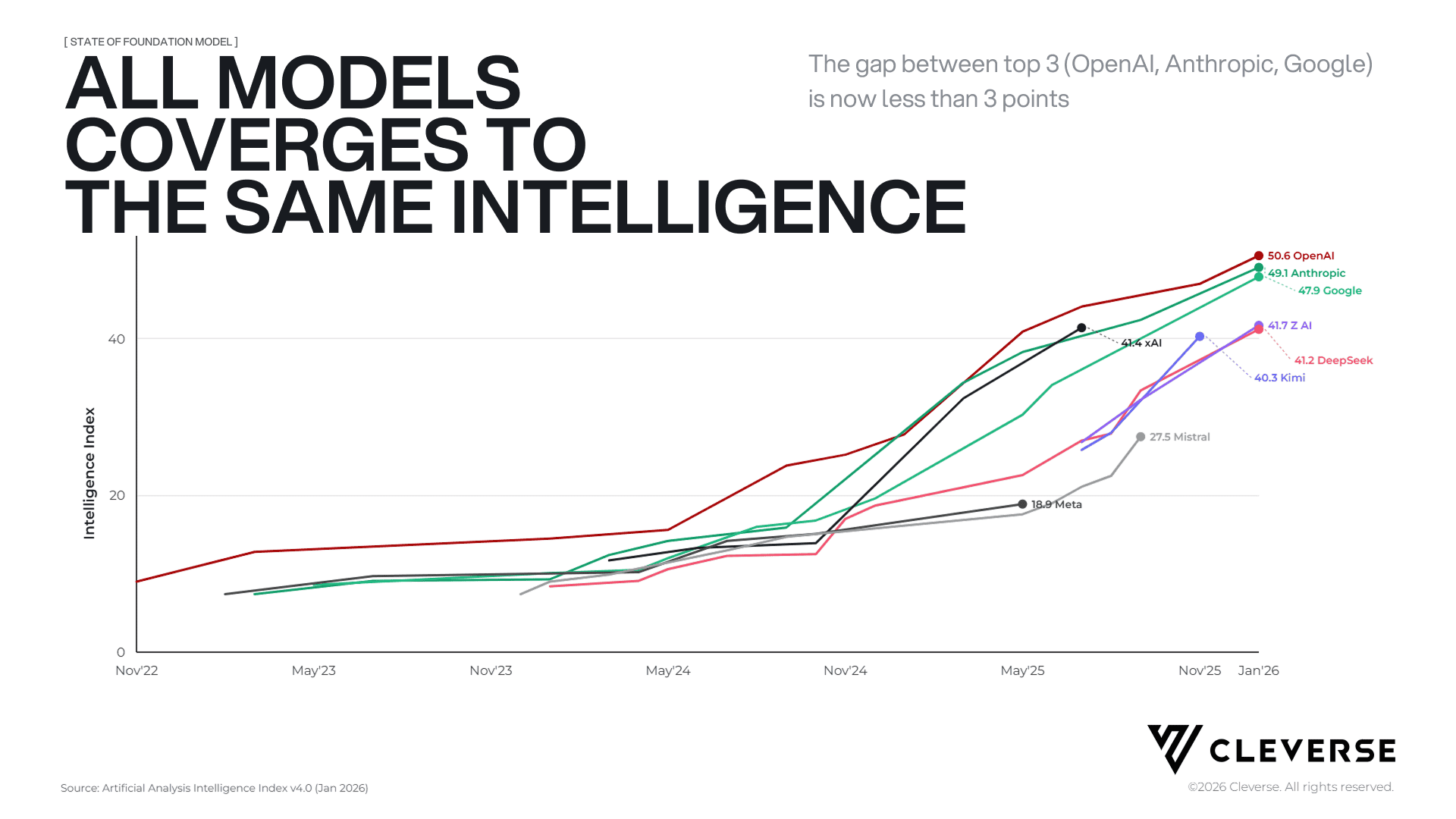

Similar Intelligence Level

OpenAI, Anthropic, and Google's Gemini were once separated by meaningful capability gaps. Not anymore. The intelligence level across the top three models is converging rapidly. When OpenAI ships gpt-5, Gemini ships gemini-pro-3 three months after.

This convergence isn't accidental—it results from closely tracking competitors and their teams’ activity on Twitter, competitive talent wars, and transparent benchmarking. But it fundamentally changes the competitive dynamics. When all three leaders reach similar capability levels, the basis of competition shifts from "who's the smartest" to "who's the cheapest" or "who productize best.”

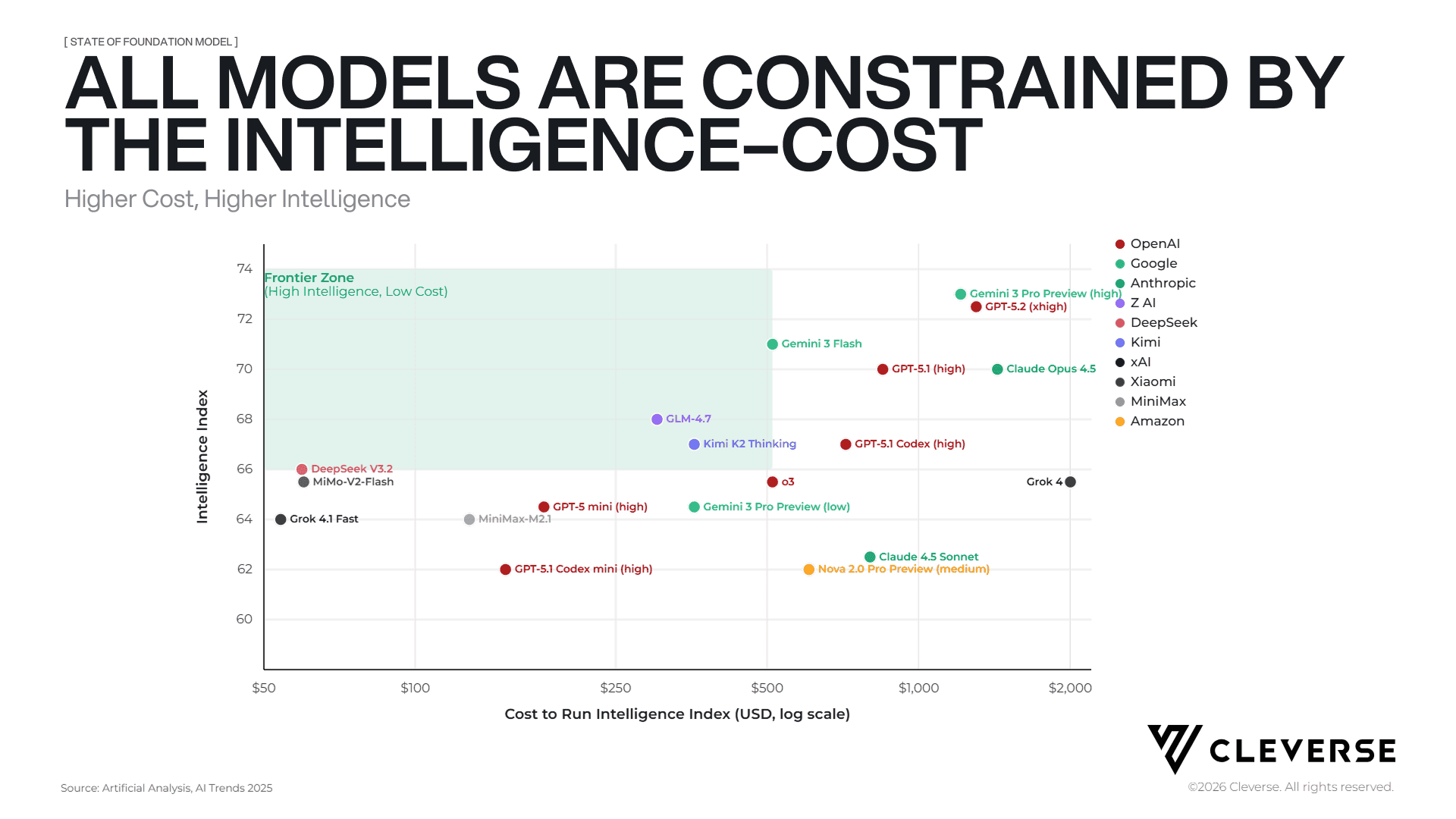

Price Wars Destroying Unit Economics

API pricing has dropped 1000x in the last two years. A model that cost $30 to query now costs $0.04, and no one has broken through the intelligence cost trade-off — the frontier zone where intelligence delivered per dollar spent can't improve further without fundamental breakthroughs. Everyone's racing down the same curve.

The Open Source Pressure

Here's the kicker: open models are reaching parity with closed models within 3-6 months. Deepseek R1 deliver 80-90% of GPT-4 or Claude's capabilities at a fraction of the cost. This puts enormous pressure on the closed model providers.

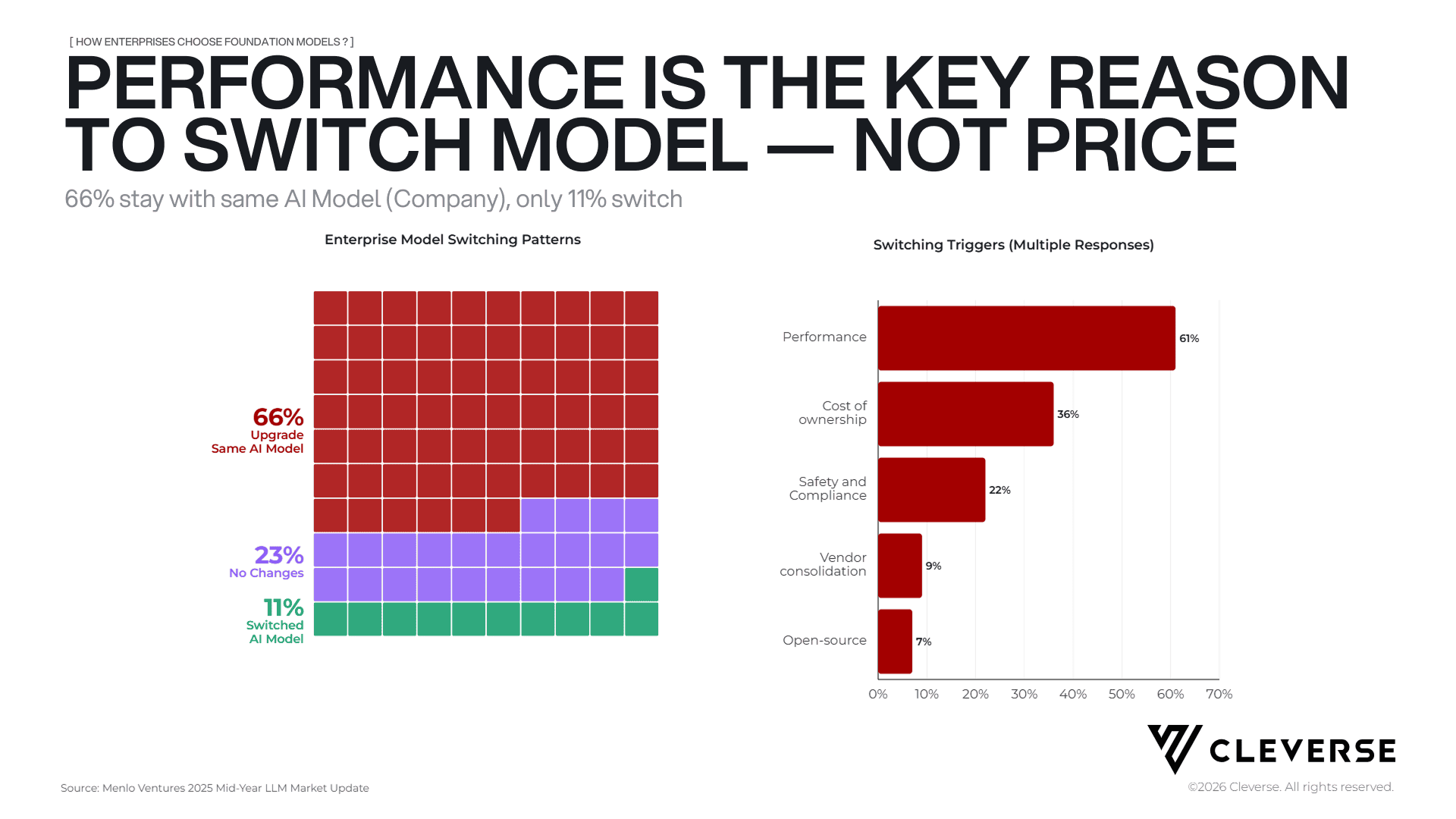

Incremental Differentiation

The performance gap between open and closed models is narrowing so fast that enterprises now evaluate primarily on the basis of new model versions from existing vendors, not new vendors entirely. They're not asking "should we switch from OpenAI to Anthropic?" They're asking "should we upgrade to the latest GPT or latest Opus?"

The problem? As models converge in capability, these improvements become increasingly incremental. We've moved from "10x better reasoning" to "5% improvement on specific benchmarks."

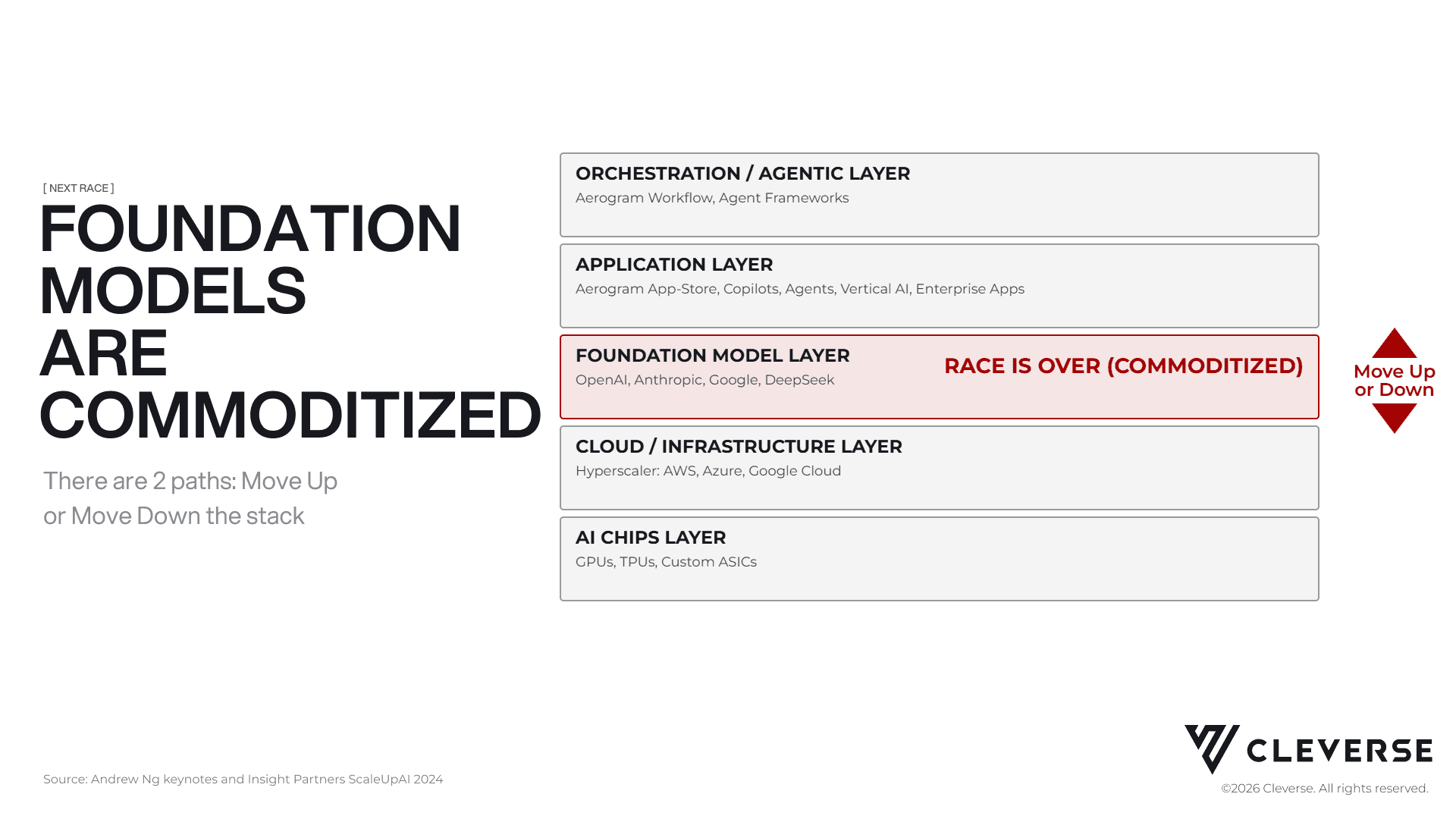

Opportunity Shift

When we're stuck in a red ocean market, we have 2 paths: commoditize your complement, or move up/down the value chain.

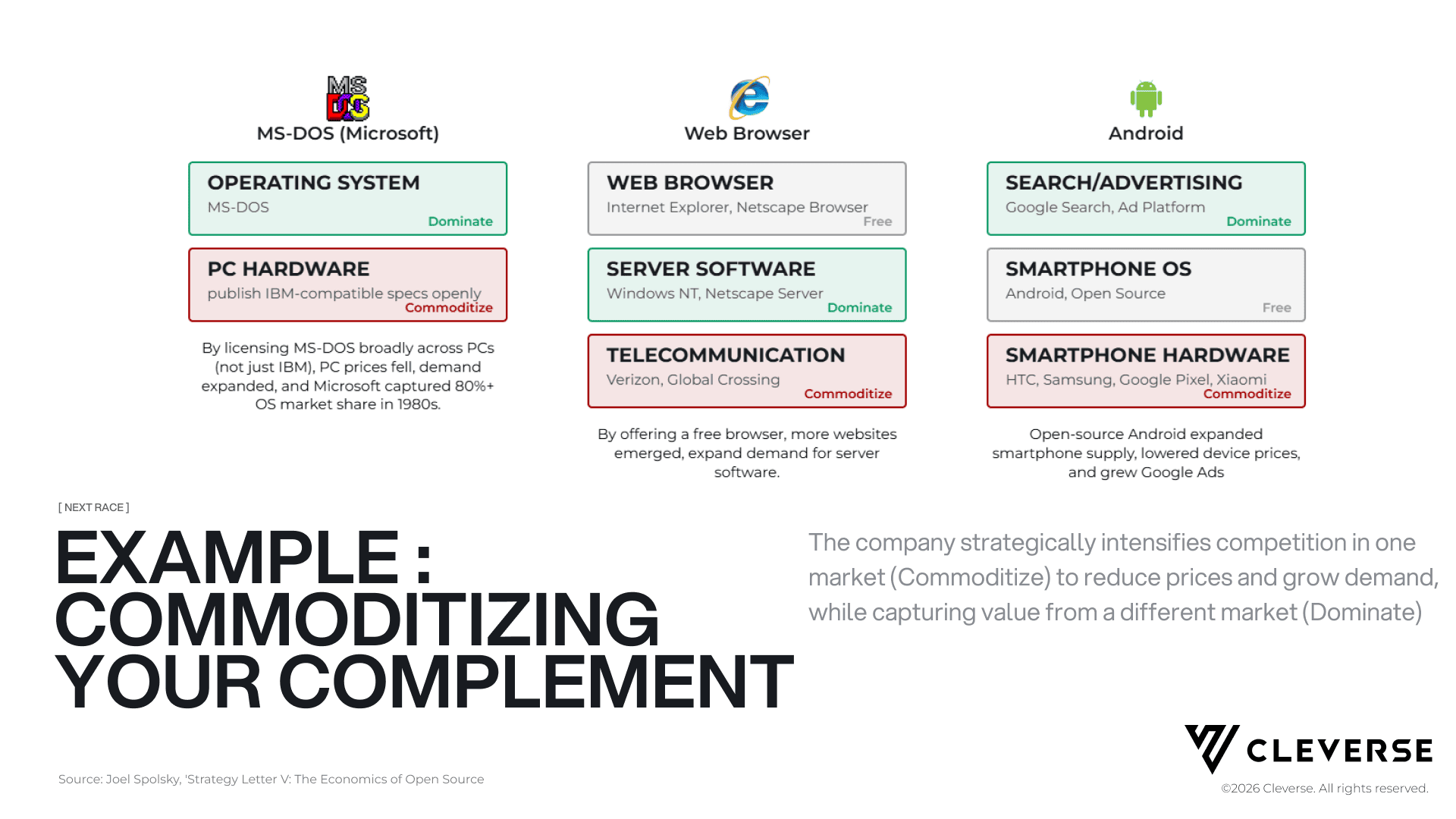

Commoditize Your Complement

Large tech companies often win by making their complement—the thing customers need alongside their product—as cheap and accessible as possible. Google open-sourced Android to drive down smartphone costs and monetize ads. Microsoft gave away Internet Explorer to commoditize telecom services and sell server OS (Windows NT).

For foundation model companies, some are trying to commoditize applications. Others are investing in the layers below.

Moving Down: The Infrastructure Play

Look at the capital expenditure (CapEx). Hyperscalers are increasing AI infrastructure spending year-over-year. This isn't optional spending—it's defensive. If AWS doesn't invest in GPU capacity, Azure will capture that workload. If Google doesn't build out its infrastructure, customers will migrate to competitors.

Data centers require massive amounts of power. As AI workloads grow, energy becomes the bottleneck. Hyperscalers are now hunting globally for countries and regions with available energy capacity. The lead time for each AI infrastructure layer matters:

- Building data center capacity: 18-24 months

- Securing GPU supply: 6-12 months

- Establishing energy infrastructure: 3-5 years

Energy is the longest lead time, which means it's becoming the critical constraint. Watch for hyperscalers to make major investments in energy-rich regions over the next few years. The foundation model wars will partly be won by whoever secures power capacity first.

Moving Up: Real Opportunity

Here's where it gets interesting. While everyone obsesses over which model is 2% better on benchmarks, they're missing where the real opportunity is being made.

Enterprise spending on GenAI applications represents only 6% of total SaaS software spending. Think about that. AI is supposed to be transforming everything, yet it's still a rounding error in enterprise software budgets.

Meanwhile, 64% of Anthropic's revenue comes from API usage by third-party AI applications. The foundation model companies aren't making money selling directly to end users—they're making money powering applications that create value for end users.

This tells us where the blue ocean opportunity actually exists: in the application layer.

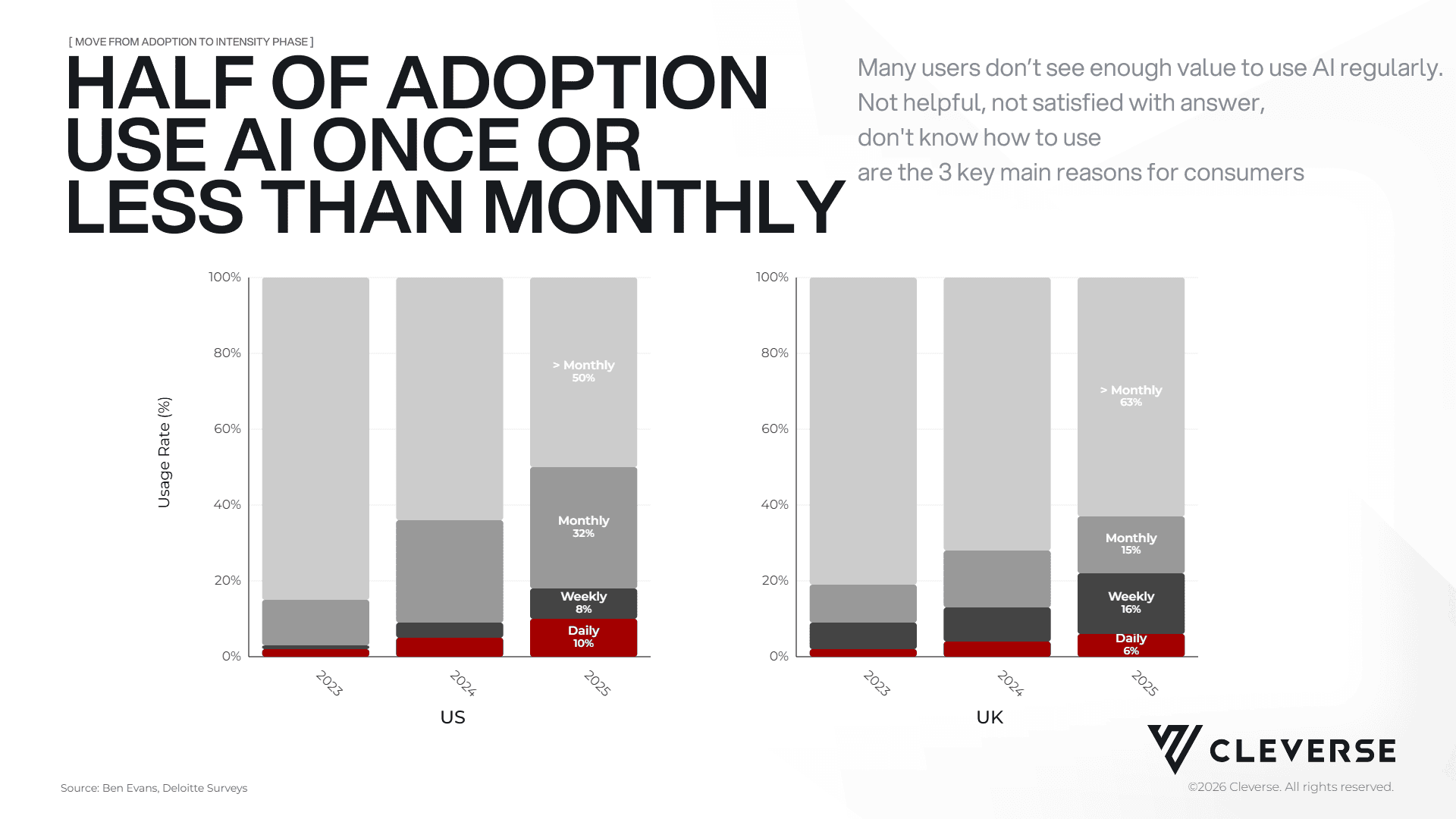

From Adoption to Intensity: The Usage Problem

AI adoption in America has plateaued. But that's not the concerning part. The concerning part is the usage intensity.

Daily active users of Consumer Chat AI remain remarkably low. Most people who try AI use it once or maybe a few times per month, then abandon it. The natural frequency of AI tool usage is far lower than expected. This isn't because the technology doesn't work—it's because users aren't getting sufficient value from their interactions.

This is a classic retention problem disguised as an adoption problem. The market has moved through the initial adoption curve. Now we're in the intensity phase, where success depends on making AI tools genuinely useful for frequent, repeated use cases.

The winners in the application layer will be those who solve for intensity, not just adoption.

Enterprise AI Outlook 2026

The biggest technology companies emerged from blue oceans—uncontested market spaces where they created new demand rather than fighting for existing customers. Facebook didn't compete with MySpace on features; it created an entirely new social graph around real identity. Amazon didn't compete with Barnes & Noble on bookstore experience; it created unlimited selection and one-click purchasing.

Four themes are emerging as potential blue ocean opportunities in Enterprise AI:

Theme 1: Modular Workflows Beat Agents

Everyone got excited about autonomous AI agents. The promise was simple: give an AI a goal, and it figures out how to accomplish it. The reality has been messier.

Agents frequently work outside their intended scope and produce bad results. They make decisions that seem logical to the AI but completely miss business context. They take actions that humans would never approve. The error compounds as agents string together multiple steps.

The solution isn't abandoning agentic AI—it's breaking down workflows differently. Instead of one autonomous agent handling an entire process, modular workflows decompose tasks into smaller, autonomous components with experts in the loop at critical junctures.

Theme 2: Non-Coder Enablers

Here's the dirty secret of successful AI implementations: enterprise all require technical people to set up and maintain them. AI demos look magical, but getting them to work reliably in your business requires business expertise who can use AI.

The problem? Technical talent isn't distributed evenly across organizations. Sales teams, operations teams, finance teams—they all have valuable use cases for AI, but they can't access the technology without going through IT or engineering. This creates a bottleneck that dramatically limits AI value capture.

The opportunity is building tools that non-technical people can configure, deploy, and maintain themselves. Not no-code in the traditional sense—most no-code tools still require significant technical knowledge. True non-coder enablement means your VP of Sales can build and deploy a sales coaching AI without involving engineering. Your head of customer success can create automated response systems without a data scientist.

This isn't about dumbing down AI—it's about radically lowering the technical barrier to value creation.

Theme 3: AI Knowledge Bases

Enterprise documents are a disaster. Every company has thousands of files scattered across Google Drive, SharePoint, OneDrive, and email. Finding information requires knowing file names, folder structures, or hunting through documents manually.

Traditional enterprise search tried to solve this with keyword indexing. But keyword search has fundamental limitations—you need to know what you're looking for and how it's phrased in the document.

AI-powered knowledge bases are different. They understand document content semantically, enabling entirely new types of queries:

- "What decisions did we make about pricing strategy in Q3?"

- "Recommend products in the catalog that match with …. customer"

The opportunity isn't just better search—it's turning unstructured enterprise knowledge into structured, queryable intelligence. This includes not just document retrieval but data ingestion from multiple sources, context-aware responses, and handling varied question types that traditional search can't touch.

The Real Opportunity is Just Beginning

The foundation model red ocean will continue. Companies will keep competing on incremental improvements, price will keep dropping, and margins will keep compressing. Some will survive by moving down the stack into infrastructure. Others will pivot to specific vertical applications.

But the real opportunity—the blue ocean—is in the application layer. Not in competing with GPT-5 or Claude 4, but in building products that make AI genuinely useful for repeated, daily work.

We're still at the beginning of the AI transformation, but the battle lines are becoming clear. The question isn't which foundation model will win. The question is: what applications will be built on top of them that create and capture real value?

That's where the next generation of AI-native companies will come from.

Full Report : The Next Battlefield After the Foundation Model War[January 2026]